EURCHF approaching support of a Rising Wedge

EURCHF is approaching the support line of a Rising Wedge. It has touched this line numerous times in the last 14 days. If it tests this line again, it should do so in the next 3 days.

Should we expect a breakout or a rebound on AUDUSD?

The movement of AUDUSD towards the resistance line of a Channel Down is yet another test of the line it reached numerous times in the past. This line test could happen in the next 3 days, but it is uncertain whether it will result in a breakout through this line, or simply rebound back to […]

What’s going on with USDCNH?

Those of you that are trend followers are probably eagerly watching USDCNH to see if its latest 0.22% move continues. If not, the mean-reversion people out there will be delighted with this exceptionally large 4 hours move.

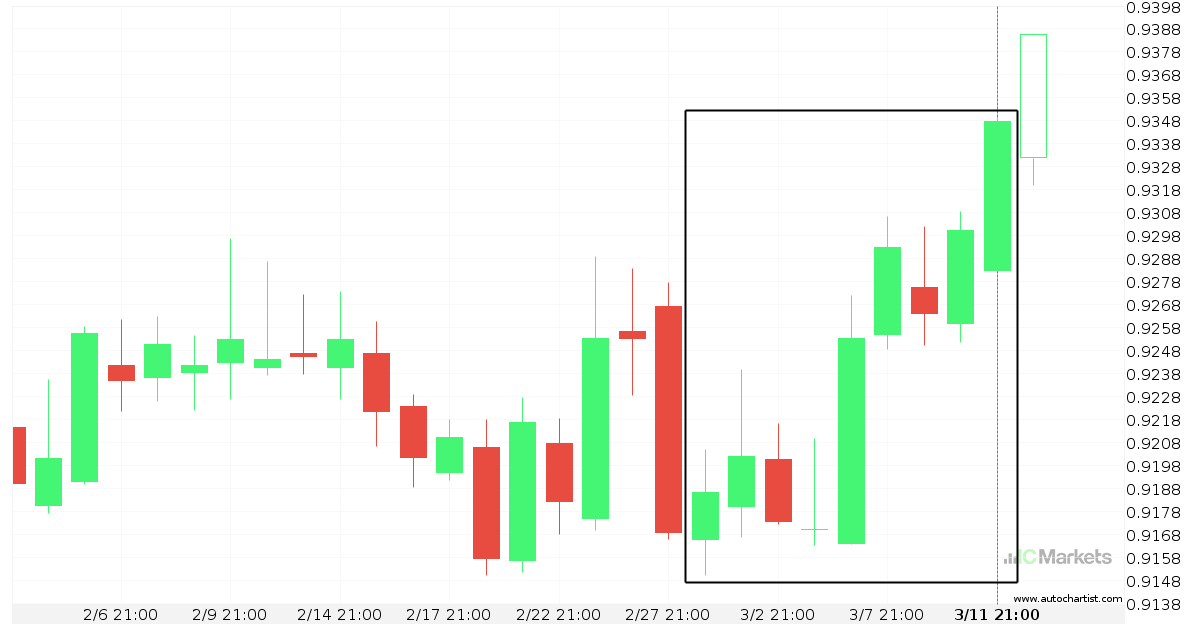

USDCHF experienced an exceptionally large movement

For those of you that don’t believe in trends, this may be an opportunity to take advantage of an exceptional 1.76% move on USDCHF. The movement has happened over the last 12 days. For those trend followers among you, you may think about riding this possible trend.

USDJPY experienced an exceptionally large movement

For those of you that don’t believe in trends, this may be an opportunity to take advantage of an exceptional 1.75% move on USDJPY. The movement has happened over the last 5 days. For those trend followers among you, you may think about riding this possible trend.

GBPUSD is on its way down

GBPUSD has experienced an exceptionally large movement lower by 3.87% from 1.353 to 1.304 in the last 31 days.

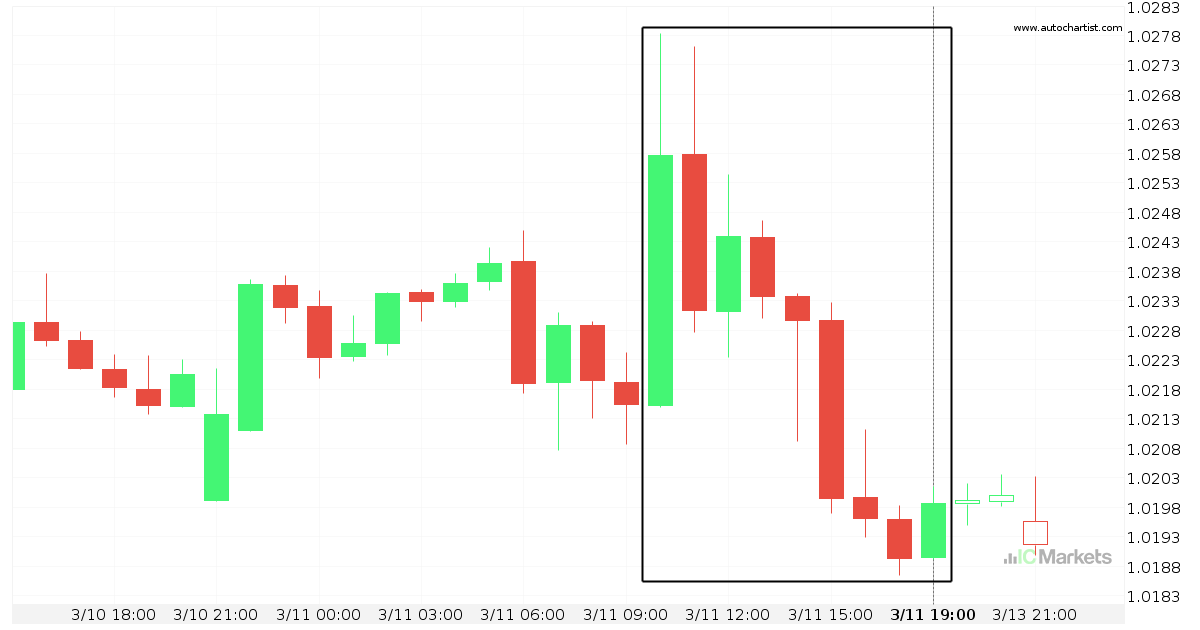

Huge bearish move on EURCHF

EURCHF has moved lower by 0.58% from 1.022 to 1.02 in the last 9 hours.

EURGBP experienced an exceptionally large movement

For those of you that don’t believe in trends, this may be an opportunity to take advantage of an exceptional 0.27% move on EURGBP. The movement has happened over the last 6 hours. For those trend followers among you, you may think about riding this possible trend.

Huge bullish move on EURUSD

EURUSD has moved higher by 2.04% from 1.093 to 1.108 in the last 4 days.

USDJPY – getting close to resistance of a Ascending Triangle

USDJPY is moving towards a resistance line. Because we have seen it retrace from this line before, we could see either a break through this line, or a rebound back to current levels. It has touched this line numerous times in the last 17 hours and may test it again within the next 5 hours.